Who Qualifies For Homestead Exemption In Nc . You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year in which you wish to. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. To qualify for the homestead exclusion, you must be either: Who qualifies for a homestead exemption? Each state — and even each county — can make its own rules about who qualifies for a homestead exemption and how much it is. North carolina allows property tax exclusions for senior adults and disabled individuals. Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at least 65 years of age or is totally and permanently disabled. Combined income limit $36,700 (applicant &.

from formspal.com

North carolina allows property tax exclusions for senior adults and disabled individuals. To qualify for the homestead exclusion, you must be either: You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year in which you wish to. Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. Who qualifies for a homestead exemption? Each state — and even each county — can make its own rules about who qualifies for a homestead exemption and how much it is. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at least 65 years of age or is totally and permanently disabled. Combined income limit $36,700 (applicant &.

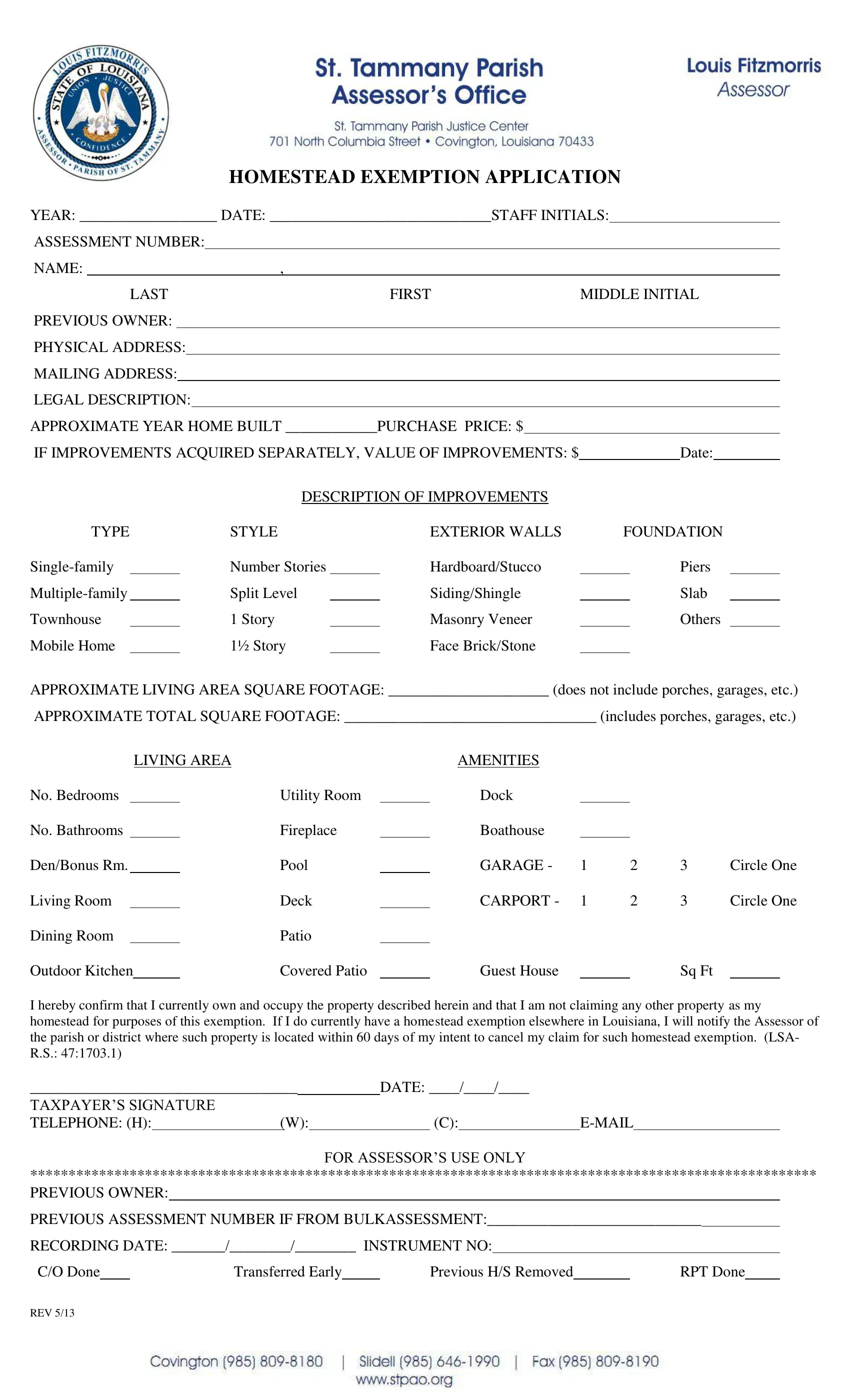

Homestead Exemption Application PDF Form FormsPal

Who Qualifies For Homestead Exemption In Nc If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year in which you wish to. Who qualifies for a homestead exemption? To qualify for the homestead exclusion, you must be either: North carolina allows property tax exclusions for senior adults and disabled individuals. Combined income limit $36,700 (applicant &. Each state — and even each county — can make its own rules about who qualifies for a homestead exemption and how much it is. Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at least 65 years of age or is totally and permanently disabled. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of.

From www.formsbank.com

Fillable Application For General Homestead Exemption printable pdf download Who Qualifies For Homestead Exemption In Nc To qualify for the homestead exclusion, you must be either: If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year in which you wish to. Combined income limit. Who Qualifies For Homestead Exemption In Nc.

From www.signnow.com

Sc Homestead Exemption 20212024 Form Fill Out and Sign Printable PDF Who Qualifies For Homestead Exemption In Nc If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year in which you wish to. Each state — and even each county — can make its own rules. Who Qualifies For Homestead Exemption In Nc.

From hometaxshield.com

Understanding the Texas Homestead Exemption Who Qualifies For Homestead Exemption In Nc Each state — and even each county — can make its own rules about who qualifies for a homestead exemption and how much it is. Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at least 65 years of age or is totally and permanently disabled. You may be qualified for the homestead. Who Qualifies For Homestead Exemption In Nc.

From www.exemptform.com

Application For Senior Citizen S Homestead Exemption Lake County Who Qualifies For Homestead Exemption In Nc You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year in which you wish to. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. To qualify for the homestead exclusion, you must be either: Each state —. Who Qualifies For Homestead Exemption In Nc.

From www.exemptform.com

Homestead Exemption Cobb County Form Who Qualifies For Homestead Exemption In Nc Each state — and even each county — can make its own rules about who qualifies for a homestead exemption and how much it is. Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at least 65 years of age or is totally and permanently disabled. Also, the homestead exemption is a state. Who Qualifies For Homestead Exemption In Nc.

From www.goamplify.com

What is a Homestead Exemption? Amplify Credit Union Who Qualifies For Homestead Exemption In Nc Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at least 65 years of age or is totally and permanently disabled. To qualify for the homestead exclusion, you must be either: North carolina allows property tax exclusions for senior adults and disabled individuals. You may be qualified for the homestead exemption if you. Who Qualifies For Homestead Exemption In Nc.

From www.exemptform.com

Harris County Homestead Exemption Form Printable Pdf Download Who Qualifies For Homestead Exemption In Nc Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. Combined income limit $36,700 (applicant &. Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at least. Who Qualifies For Homestead Exemption In Nc.

From www.noffcu.org

What is the Homestead Exemption? Who Qualifies For Homestead Exemption In Nc To qualify for the homestead exclusion, you must be either: Combined income limit $36,700 (applicant &. North carolina allows property tax exclusions for senior adults and disabled individuals. Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. You may be qualified for the homestead exemption if you are at least 65. Who Qualifies For Homestead Exemption In Nc.

From www.etsy.com

Homestead Exemption Letter Reminder Template Etsy Who Qualifies For Homestead Exemption In Nc Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. North carolina allows property tax exclusions for senior adults and disabled individuals. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. Under north carolina law, a homeowner qualifies for a homestead property tax. Who Qualifies For Homestead Exemption In Nc.

From movingtothefloridakeys.com

Secure Your Homestead Exemption Today! Who Qualifies For Homestead Exemption In Nc You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year in which you wish to. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. Each state — and even each county — can make its own rules. Who Qualifies For Homestead Exemption In Nc.

From prorfety.blogspot.com

What Qualifies You For Homestead Exemption PRORFETY Who Qualifies For Homestead Exemption In Nc You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year in which you wish to. Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at least 65 years of age or is totally and permanently disabled. If you qualify,. Who Qualifies For Homestead Exemption In Nc.

From www.formsbank.com

Application For Homestead Property Tax Exemption Form printable pdf Who Qualifies For Homestead Exemption In Nc Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at least 65 years of age or is totally and permanently disabled. Who qualifies for a homestead exemption? North carolina allows property tax exclusions for senior adults and disabled individuals. To qualify for the homestead exclusion, you must be either: Combined income limit $36,700. Who Qualifies For Homestead Exemption In Nc.

From offgridgrandpa.com

Who Qualifies For Homestead Exemption In Mississippi? ( Guide ) » Off Who Qualifies For Homestead Exemption In Nc Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year. Who Qualifies For Homestead Exemption In Nc.

From www.investopedia.com

Homestead Exemption What It Is and How It Works Who Qualifies For Homestead Exemption In Nc To qualify for the homestead exclusion, you must be either: Combined income limit $36,700 (applicant &. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. North carolina allows property tax exclusions for senior. Who Qualifies For Homestead Exemption In Nc.

From www.exemptform.com

Berkeley County Auditor Homestead Exemption Form Who Qualifies For Homestead Exemption In Nc To qualify for the homestead exclusion, you must be either: Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. Combined income limit $36,700 (applicant &. North carolina allows property tax exclusions for senior adults and disabled individuals. If you qualify, you may receive an exclusion of either $25,000 or 50% of. Who Qualifies For Homestead Exemption In Nc.

From www.pdffiller.com

Fillable Online wpcontentpdf templates2022 APPLICATION FOR Who Qualifies For Homestead Exemption In Nc North carolina allows property tax exclusions for senior adults and disabled individuals. Combined income limit $36,700 (applicant &. Also, the homestead exemption is a state law subject to the supremacy clause of the united states constitution. If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. Who qualifies for a homestead exemption?. Who Qualifies For Homestead Exemption In Nc.

From www.firsthomehouston.com

How to Apply for Your Homestead Exemption Plus Q and A — First Home Who Qualifies For Homestead Exemption In Nc Each state — and even each county — can make its own rules about who qualifies for a homestead exemption and how much it is. North carolina allows property tax exclusions for senior adults and disabled individuals. Combined income limit $36,700 (applicant &. Under north carolina law, a homeowner qualifies for a homestead property tax exemption if he is at. Who Qualifies For Homestead Exemption In Nc.

From support.wcad.org

Homestead Exemption vs Homestead Designation Who Qualifies For Homestead Exemption In Nc If you qualify, you may receive an exclusion of either $25,000 or 50% of the taxable value of. Who qualifies for a homestead exemption? Combined income limit $36,700 (applicant &. You may be qualified for the homestead exemption if you are at least 65 years of age on january 1 of the tax year in which you wish to. Also,. Who Qualifies For Homestead Exemption In Nc.